To better understand, measure and analyse stakeholder interest, attitude and knowledge about CHEST technology, we have reached out to all interested parties and ask them about our project. 65% of all participants see the technology positively and agree that CHEST could bring new opportunities for their organisation or the sector.

During the period of 23 March – 10 June 2020, we have collected 70 responses from all stakeholders across the CHESTER project value chain. Only 31 of all answers were complete and therefore, used for our analysis, as well as to improve the project dissemination and exploitation strategy.

Nearly half of the respondents are directly or indirectly involved with heat pumps, heat engines or heat storage. Based on this characteristic, an online discussion with the Research & Innovation (R&I) committee of the European Heat Pump Association (EHPA) was organised on 10 June 2020, where further input from the 13 participating committee member was sought (see related post for more information). Due to the increased interest of stakeholders active with these technologies, the analysis has been conducted twice; once for the entire input collected and once for the part of the sample related to heat pumps, heat engines and heat storage in order to identify any technology specific differences in interests and attitudes towards CHEST.

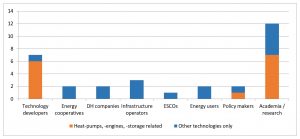

The respondents cover a wide range of types of organisations such as research and technology developers, infrastructure operators, DH companies, cooperatives, ESCOs and energy users as well as policy makers (Figure 1).

Figure 1. Types of organisations the respondents came from.

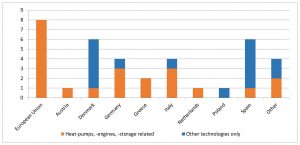

Most of the them come from Denmark, Spain, Italy, Germany, Greece, Austria, the Netherlands, Poland and the wider EU, along with UK and Switzerland (Figure 2).

Figure 2. Countries where the respondents are active in.

Current and future flexibility services

When it comes to flexibility services the respondents were asked to indicate the markets they currently participate in as well as those they see potential for in the future. This question covers any flexibility technology they might be using and aims to identify any value streams that have potentially been left out of scope within CHESTER and should be considered. Responses from 5 technology and project developers, DH companies and ESCOs indicate that they are currently in a position to participate in markets covering the following:

- Transmission system (TSO) services (e.g. frequency response, reserve services, black start, investment deferral, congestion management, etc.)

- Intraday and Day-ahead energy markets (i.e. price arbitrage)

- Services to Balancing Responsible Parties (BRPs) (i.e. imbalances reduction)

- Collocation with renewables and behind-the-meter services (e.g. maximisation of self-consumption, optimisation with on-site renewables etc.)

In addition to these, interest in further markets is expressed for potential future services, as and when they mature from a regulatory and market viewpoint:

- Distribution level (DNO/DSO) local services (e.g. congestion management, investment deferral, etc.)

- Local energy markets (e.g. distributed peer-to-peer trading)

- National capacity markets

Organisations involved with research cover all the above markets and services while there seems to be a stronger focus on decentralised energy services (i.e. behind-the-meter, DSO and local trading), which is indicative of the latest developments we see in the energy sector, with decentralisation being one of the major trends.

A DH company has indicated that a potential application of CHEST in heating services could be for replacing peak heating gas boilers in a DH network, while a heat-pumps technology provider commented that the CHEST could be integrated in systems using heat-pumps in such way that it provides speedy preheating services until the moment heat pumps are warm enough to take over.

Grid operators (not developing or owning storage assets according to the unbundling principle), indicate that the technology should reach the point where it can provide system services in equal terms with other competing technologies.

Potential of CHEST & interest in exploitation

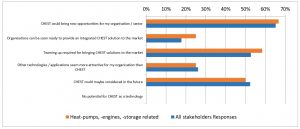

65% of all stakeholders participating in this survey see the technology positively and agree that CHEST could bring new opportunities for their organisation or the wider sector while the wasn’t any respondent indicating there is no potential in the technology (Figure 3).

Responses indicate that only an 18% of the stakeholders can soon be ready to provide an integrated CHEST solution to the market while around half of them agree that this can only be achieved in the future and after collaborative efforts between different stakeholders. It is interesting to see that technology and research organisations involved with heat pumps, heat engines or heat storage show a higher readiness level for bringing such a solution to market but also see a higher need for collaboration, which can be explained by the fact that they have more practical experience with the main technologies involved in the solution.

Figure 3. Stakeholder views on potential of CHEST & their interest in exploitation.

Potential hurdles for CHEST

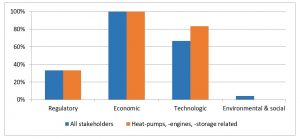

Stakeholders were finally requested to assess any barriers they see to the deployment of CHEST. There is a clear consensus that the most important barrier is the high costs of such a system, especially when compared to the economic performance of other storage solutions already in the market, which CHEST will have to compete with in a level playing field (Figure 4).

More specifically, qualitative input collected indicates that:

- More experience with CHEST is required in order to drive down investment costs, i.e. components and parts, assembly, start-up and operation;

- A detailed comparison of the economic performance of the system is proposed in order to assess where the technology stands in comparison to competing setups;

- More advantageous pricing and tax schemes for innovative storage technologies like CHEST have been proposed from a small number of stakeholders in order to help level the playing field for them until market uptake.

Figure 4. Stakeholder views on potential hurdles for CHEST.

Two thirds of the respondents see technologic barriers as the second most important ones hindering the further deployment of CHEST while, interestingly, the same figure is significantly higher (around 80%) within organisations active in the area of heat pumps, heat engines or heat storage, potentially due to the better understanding they have with regards to the technical implications of an integrated CHEST solution. More specifically, feedback indicates that:

- Demonstration over at least a year is required to evaluate scalability and power range of the system;

- Speed and durability of response to signals are key as they will define the services that can be provided and therefore the markets that can be accessed;

- The integration of the cycle needs to be considered in combination with variable RES and DH;

- Techno-economic feasibility needs to be thoroughly investigated through deep experimental demo site validation;

- The technology needs to pass performance tests before it can participate in grid services

- Further EU funded R&D has been proposed in order to improve system performance and verify the reliability of the operation of the system.

Third in ranking (33%) come regulatory and market framework related hurdles with comments evolving around:

- Double charges are a common challenge facing all storage technologies as the regulatory frameworks generally consider them as both generation and consumption assets straining the grid, instead of assets that contribute to relieving strains from it;

- Awareness among policy makers, associations, etc. needs to be raised to provide better and clearer regulatory conditions and support for this technology.